- Discussions/

- #8/

[Forum Migration Postings] Treasury propoal: KSM initial liquidity subsidy for KSM staking liquidity derivative - vKSM

NOTE: This is crossposted at Kusama Polkassembly

Proponent Address: F7fq1jMmNj5j2jAHcBxgM26JzUn2N4duXu1U4UZNdkfZEPV (parachain 2001)

Requested Amount: 50,000 KSM

Date: 13.06.2022

Product Link: https://bifrost.app/vstaking/vKSM

vKSM mechanism: https://wiki.bifrost.finance/learn/mechanism/slp/vksm

Summary

Bifrost (https://bifrost.finance) is a substrate developed web3 derivatives protocol that provides decentralized cross-chain liquidity for staked assets. Bifrost’s mission is to provide standardized cross-chain interest-bearing derivatives for Polkadot relay chains, parachains and heterogeneous chains bridged with Polkadot.

From the Bifrost Finance team, this proposal asks the Kusama treasury to lend a** total of 50,000 KSM** (with interest) as initial base liquidity for the KSM and vKSM (staking liquidity derivative for KSM) pair. This Initial liquidity subsidy is fundamental in ensuring liquidity backing and support for this pair such that vKSM can become a pillar of the Kusama ecosystem kick-starting its usage across various DeFi applications and scenarios within the Kusama and broader Polkadot ecosystem and driving KSM related economic growth and adoption. In addition, this loan will achieve the following benefits for the Kusama ecosystem and to the community:

- Provide liquidity for staked KSM and promote the capital utilization of KSM in various defi scenarios and applications (refer to section 3). This initial liquidity subsidy provides backing to vKSM being a catalyst in driving the expansion of KSM’s multichain economy.

- Bifrost will develop SLP pallet (vKSM minted pallet) ) SDK and Stable Asset Pool SDK for cross-chain vKSM mint/redeem calling convenience. The remote SDK call will facilitate cross-chain liquidation for vKSM/KSM.

- Further improve the incentives for users to nominate and pledge tokens;

- Improve the enthusiasm of KSM holders to participate in staking;

- Borrow money from the Treasury and pay interest, increase treasury funds utilization

In addition, from the perspective of Kusama’s ecosystem consensus security, the Bifrost parachain limits the maximum casting amount of vKSM to no more than 30% of the total KSM.

The liquidity subsidy of 50,000 KSM will be 100% repaid in full plus interest (refer to section “Liquidity Loan and Repayment Process” for details).

Why Bifrost Finance?

Since Bifrost went live on the Kusama parachain on October 21, 2021, it has minted a total of $70M in derivatives, provided about $6M in DEX liquidity, held 81,640 addresses in the chain, and completed 361,553 signed transactions.

At the cross chain level, Bifrost has completed the opening of HRMP channels (Karura, statemine, Khala and Moonriver) with four parallel chains, and used multichain bridge to bring 18,000 vETH (our liquid staking derivative for ETH 2.0) contract from Ethereum to Moonriver EVM of the Kusama ecosystem.

Recently Bifrost has successfully bid for slots 21-28 before Kusama parachain slots expire. Bifrost will migrate main protocols from Kusama to Polkadot the Kusama <> Polkadot cross-chain bridge matures. With Bifrost Staking Liquidity Protocol (SLP) now live, and once Bifrost polkadot parachain goes online, Bifrost aims to provide standardized cross-chain staking liquidity derivatives for Polkadot relay chains, parachains and heterogeneous chains bridged with Polkadot. Through Polkadots’ unique cross chain interoperability, Bifrost will enable derivatives with parachains to be directly cast and circulated in their own ecosystem.

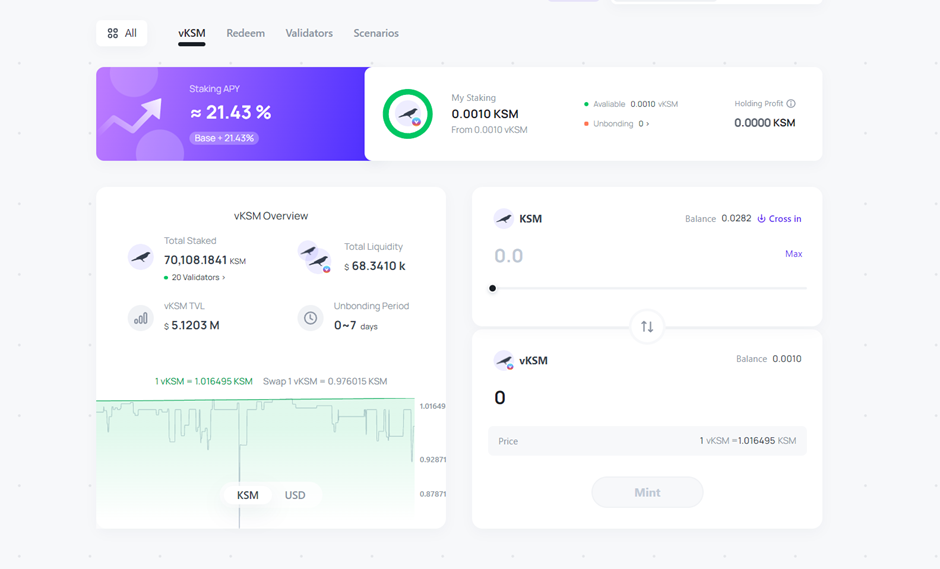

vKSM is Bifrosts’ first staking liquidity derivative and since its official launch on May 16th, approximately 70,000 vKSM (roughly USD 5.1M) have already been minted.

Bifrost vKSM dapp dashboard - snapshot:

SDK and middle layer objectives for Bifrost

Bifrosts’ middle layer objective is to push multi-chain KSM & vKSM functional calling from other sides to the Substrate side. To achieve this, Bifrost is developing SLP pallet (the pallet mints vKSM) SDK for cross-chain vKSM mint/redeem calling.

vKSM has its native advantages: yield bearing from staking and its pegged price with KSM, which are suitable characteristics for vKSM being a collateral asset in lending and borrowing protocols. Bifrost would push vKSM and further vTokens collateral feature to accumulate liquidity by using Taiga’s Stable Asset pallet in Bifrost (learn more details in “vKSM utility implementation plan” section) , develop SDKs which can be called in cross-chain scenarios for remote liquidation.

In the above cases, interoperability is built upon three core Substrate factors: XCM, parachains which are compatible with other consensus and Bifrost pallet. Thus, we think it’s important to use Polkadot native features to build cross-chain liquidity.

Motivation

Facilitate Capital Flow of KSM staking

KSM, as the governance token of Kusama, about 50% of the total amount of KSM is currently in staking. Bifrost hopes to activate the capital utilization of staked KSM while empowering the security of the Relay-chain consensus, and promote the activity of Kusama Staking. Thus, Bifrost has developed a liquidity derivative protocol for Staking KSM: vKSM, a new derivative that is anchored 1:1 with staked KSM and comes with KSM staking income. Bifrost hopes to borrow 50,000 KSM from the Kusama Treasury as the base liquidity.

Enhance the consensus security of Kusama network and reduce the threshold for users to participate in staking

Bifrost’s KSM liquidity pledge agreement (staking liquidity protocol-SLP) completes the cross chain nominating of KSM by calling XCM at the runtime level, and SLP pallet completely controls and casts vKSM. In the whole process, the SLP protocol will select the validator with no security risk and reasonable rate of return through the governance on the chain to help users complete the one-stop nominate, and complete the final voting through the “Sequential Phragménd Method“ on the Kusama chain. In the future, after xcm supports the status of parachain query relay chain validator, SLP will complete intelligent filtering for the validator set.

Therefore, vKSM can help any user willing to stake, complete the pledge without knowledge threshold, and use governance screening to improve the overall staking quality. Staking with mobility will be integrated with rich DeFi scenes to stimulate more users to participate in the nominated proof of stake.

vKSM utility “implementation plan”

Application scenarios

As more and more DeFi projects appear in the Dotsama ecosystem, the conflict between Staking rewards and DeFi interest will become increasingly obvious, and vKSM is one of the most effective solutions to this conflict.

Building and establishing vKSM utility within DeFi scenarios as well as promoting it within EVM ecosystem as xcvKSM are key priorities for the team. Bifrost will actively expand the application of vKSM scenarios, such as the provision of XCM SDK, being a convenient solution for each parachain to directly mint vKSM across chains, and apply vKSM to the corresponding parachains ecosystem.

These opportunities will not only benefit collaborating projects in terms of sharing liquidity, driving TVL, and attract builders to build open this featured asset but will also allow for protocols and applications to attract end users and promote broader cross chain adoption. As a result,initial liquidity establishment for KSM/vKSM is a prerequisite to ensure that with sufficient liquidity vKSM can have utility in different DeFi applications. The following subsections highlight such use cases and the importance of liquidity for such utility developments to take place.

These opportunities with both vKSM and xcvKSM are being worked on with the different partner projects and protocols and will be communicated to users and the community once finalized and live.

1. vKSM & xcvKSM - Collateral

Considering that the minted vKSM is an asset with no liquidation risk, but contains staking interest, it is very suitable as a collateral asset in lending and borrowing protocols, thus borrowing cross-chain assets through vKSM is one example of how vKSM can activate asset utilization in DeFi scenarios. For example, Moonwell Apollo is the largest borrowing and lending protocol on Moonriver and is the first to support XC-20 assets, starting with xcKSM. In order to enable xcvKSM as a collateral asset, good xcKSM/MOVR and vKSM/xcKSM liquidity has to be ensured for this to work. Typically, Moonwell requires $5M in DEX liquidity in a pair such that it can enable collateral for an asset as well as a Chainlink price feed oracle for the asset. As a result, the treasurys’ liquidity subsidy is vital in kick-starting quick initial liquidity accumulation for KSM such that vKSM (xcvKSM) can become a suitable candidate for a collateral asset.

Following discussions with the Acala team, we have discussed the potential of vKSM becoming an accepted and independent collateralized asset for minting Acalas’ aUSD- Polkadots native stablecoin. However given current market conditions and sentiment, as well as other factors such as Acala updating its liquidation module framework and Gauntlets market risk evaluation methodology and process, we will be first closely collaborating with Tapio-Taiga protocol to ensuring minting of aUSD through taiKSM via the KSM/vKSM stable pool (please read the following section).

It is important to note that in order to successfully ensure vKSM as a collateral asset, Bifrost is working closely with partner projects and associated parties to meet and guarantee minimum requirements and standards to help the protocol unlock more borrowing scenarios whilst also ensuring protocol safety. As a result, we need to collectively ensure that the individual asset does not contribute to any outsized risk to the protocol we are partnering with. These processes will take time. Bifrost firmly believes that a fundamental step towards this objective is by the collaborative action of the Kusamas’ treasury liquidity provision for vKSM and Bifrosts incentivisation plans of such pools with partners to reach TVL and volume targets in order to meet risk standards/parameters that can balance both capital efficiency and risk of vKSM as a collateral asset.

2.vKSM - ”Stable pool” + taiKSM <> aUSD from Tapio-Taiga protocol

We have collaborated with Taiga protocol, the sister project of Tapio, a synthetic asset protocol which enables efficient liquidity for uniform assets by synthesizing different formats of assets in a highly usable synthetic asset such as taiKSM. In other words, taiKSM will be synthesized from KSM and vKSM and taiKSM can then be used as a collateral to mint aUSD while maintaining the underlying rewards generated from liquid staking. Thus through taiKSM, users will be able to benefit from stable swap for underlying yield and stable asset for use cases. Currently, the Taiga-Tapio team is upgrading and finalizing the taiKSM to stable asset v2 code and is undergoing internal review and testing such that taiKSM can support cross-chain pooling and once implemented, Taiga protocol will be integrated into the Bifrost parachain as the first parachain after Acala. Furthermore, the Taiga protocol team is directly collaborating with Acala to ensure taiKSM as direct collateral asset for aUSD minting.

3. vKSM & xcvKSM - liquidity and farming LP

We will pursue in building liquidity and farming opportunities with both vKSM and xcvKSM and other assets on different ecosystem DEXs such as Zenlink (KSM-vKSM LP already live vKSM-KSM-LP) and in Moonriver with Solarbeam. Bifrost and such DEX partners and other teams will collaborate and provide further incentives/rewards for these vKSM pools to build and drive more liquidity across ecosystems and projects.

For further information on vKSM (why, how it works and its architecture)

https://wiki.bifrost.finance/learn/mechanism/slp/vksm

Proposal

Amount

We apply to borrow 50,000 KSM liquidity subsidy from the Kusama Treasury.

Liquidity subsidy:

For a detailed description, please see the section “Liquidity Loan and Repayment Process” below.

On-chain instruments used to provide liquidity to this proposal

- Solarbeam

DEX

Solarbeam is a decentralized exchange, providing efficient liquidity and enabling peer-to-peer transactions on the Moonriver Network. Their goal is to provide a comprehensive and convenient, one-stop platform for the Kusama community.

Why Solarbeam?

Top-tier dex protocol in Moonriver parachain’s ecosystem - largest in terms of TVL

EVM & Substrate dual environment compatible feature for KSM/vKSM

Stable-swap functionality for KSM/vKSM

Given that it has the largest MOVR/xcKSM pool within the Moonriver ecosystem (approx. USD 6.9M TVL) and with later KSM/vKSM, these liquidity pools can be used for liquidation on Moonwell Apollo (a top-tier open lending & borrowing DeFi protocol built on Moonriver Moonwell Finance - Apollo)

Additional Information

Website: https://solarbeam.io/

Github: https://github.com/solarbeamio/ 1

- Taiga protocol

Taiga is a synthetic asset protocol designed to enable maximum efficiency for uniform assets on Kusama. Bringing efficient liquidity for Parachains, Liquidity Providers, Traders and Project Teams. Taiga is built using Substrate Pallets and deployed on Karura. Taiga protocol pallets are integrated with Karuraswap pallets to share liquidity across the network and allow cross-DEX trading.

Why Taiga protocol?

Substrate based pallet deployed on Kusama parachains

taiKSM aggregates different liquid-KSM liquidity

strong collaboration with Acala specifically Karura DEX and taiKSM will be the collateral asset for aUSD borrowing

Stable Asset Pool V2 supports vKSM/KSM stable swap

Additional Information

Website: https://taigaprotocol.io/

Github: https://github.com/nutsfinance/stable-asset

Time Horizon

1 Year (52 weeks)

Audits

We are conducting a joint audit with SlowMist, the expected delivery for this report is the 17th of June 2022.

Liquidity Loan and Repayment process

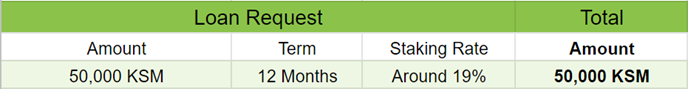

The Loan request demonstrated in the table below:

Loan Request

50,000 KSM to fill both Solarbeam DEX and Taiga Protocol for KSM-vKSM stable pool for 1 year of which:

25,000 KSM provided as KSM liquidity to both protocols (12’500 KSM each);

The other 25,000 KSM will be converted into vKSM first with around 19% staking interest, and then provided as vKSM liquidity (12’500 KSM each) in both pools;

The LP borrowing term is 12 months.

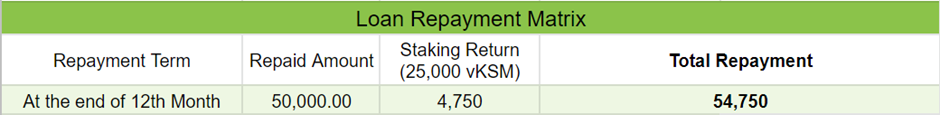

Loan Repayment

50,000 KSM 100% repaid in full plus interest.

- The subsidy will be one-time repaid at the end of the 12 months period;

- As the price of vKSM increases with staking rewards 25,000 KSM liquidity will be accompanied by 19% staking interest when Bifrost repays, thus 4,750 KSM will be added to the final repayment, the total repayment amount should be around 54,750 KSM;

- 50,000 KSM LP 100% repaid has no impermanent loss. Due to each vKSM having one KSM staked as an underlying, thus the price fluctuation on KSM reflects the same on vKSM. Since vKSM can always redeem KSM 1:1 no matter how many positions the LP provider eventually withdraws, providing LP will not obtain less asset value than holding positions, so vKSM/KSM LP has no risk of impermanent loss.

KSM-vKSM LP Matrix

We have used the amount of upcoming Crowdloan KSM unlocking (Kusama parachain expiries) and the timeline as reference to set the success goal for the LP. There are 7 unlocking batches in less than 1 year by 2023/4/23, Bifrost’s vKSM minting target is 16% in each batch, and we have set up a 10% LP target for each vKSM minting batch , thus the total LP target is 50,439.39 KSM, hence our loan request of 50,000 KSM for the liquidity subsidy from the treasury.

Please check the details in the link below:

https://docs.google.com/spreadsheets/d/1IESz3IQlL3v86Pd0Wp7aBcX16rwGwCV0QmTmlqC4DIw/edit#gid=0

Tracking

The following metrics can be used to track initiative progress:

- Solarbeam DEX for live TVL of the stable KSM/vKSM pool Stable Farm Live

- Taiga protocol via dashboard Dashboard

Managing the Funds

Tracking Borrowing and Repayment Process

Bifrost will complete the borrowing/repayment process of the 50,000 KSM subsidy through a fully open and transparent process on Kusama and Bifrost governance.

PR: https://github.com/bifrost-finance/bifrost/pull/603 1

Borrowing Process

- Kusama side

Apply to Kusama treasury to borrow 50,000 KSM to the ParaId2001 (GLiebiQp5f6G5vNcc7BgRE9T3hrZSYDwP6evERn3hEczdaM) beneficiary through the (Treasury::propose_spend) method of the treasury module on Kusama.

Bifrost side

Generate Bifrost treasury derived address via Utility::derivative_account_id method;

Through the Tokens::set_balance method, an additional 50,000 KSM will be issued on Bifrost treasury derived address;

Transfer 50,000 KSM from Bifrost treasury derived address to the treasury (eCSrvbA5gGNYdM3UjBNxcBNBqGxtz3SEEfydKragtL4pJ4F) address via the Tokens::force_transfer method;

Mint 25,000 KSM into about 25,000 vKSM via VtokenMinting::mint method;

Add 25,000 KSM and corresponding minted 25,000 vKSM trading pairs to Taiga Protocol and Solarbeam to provide liquidity.

Additional

- In the actual transaction, steps 4 and 5 need to be called through the utility.dispatchAs method.

- In the actual transaction, steps 1-5 need to be packaged into one transaction through utility.batchAll.

Repayment process

- Bifrost side

- Remove liquidity from TaigaProtocol and Solarbeam, retrieve the liquidity of the KSM-vKSM trading pair to the treasury account;

- With the VtokenMinting::redeem method, almost 25,000 vKSM is converted back to more than 25,000 KSM;

- Transfer about 54,750 KSM from Bifrost treasury address to treasury derived address via Tokens::force_transfer method;

- Through the Tokens::set_balance method, clear the close to 54,750 KSM on the treasury derived address.

- Kusama side

- Return about 54,750 KSM on ParaId2001 to Kusama treasury address (F3opxRbN5ZbjJNU511Kj2TLuzFcDq9BGduA9TgiECafpg29).

About provide/redeem LP on Solarbeam:

Since XCM currently does not support remotely calling Solarbeam’s contract from Bifrost to complete the provide/redeem LP operations, Bifrost can only use the multisig solution of Bifrost Council members to operate xcKSM and xcvKSM on Solarbeam.

We hope to be as open and transparent as possible, and welcome constructive feedback to discuss this mulitisig plan in the proposals discussion forum.

Potential Risks

Treasury liquidity may be lost if validator slashes, Bifrost would do the compensation if slash occured. Bifrost reserves 5% of BNC allocation as the Slash insurance fund for Slash compensation within 10% of SLP total staking. If slashes overtake 10%, the SLP protocol will start an emergency stop, vKSM price will be reduced (because the total amount of underlying KSM is reduced), unstake all deposits and redeem back to users.

Edited

Reply

Up

Share

Comments